Tuesday was Tax Day, and it’s a good reminder about the overhaul to the tax code, which was enacted at the beginning of the year. Here’s where deductions for homeownership costs stand this tax year (for which taxpayers would file next year). The new federal tax law still allows taxpayers to deduct the interest on home equity loans that are used for home improvements, although there are some exceptions. The IRS issued guidance at the end of February to clarify the rules.

Read more: What Tax Reform Means to Homeowners, Real Estate Pros

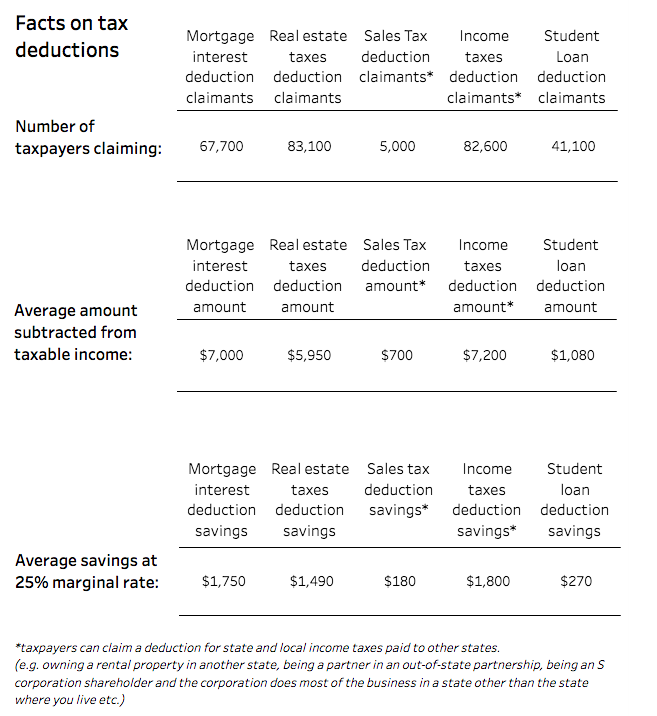

Also, a limit has been placed on the mortgage interest deduction. Starting this year, taxpayers can only deduct interest on mortgages worth $750,000 or higher, or $375,000 or higher for married taxpayers filing separately. That’s down from $1 million or $500,000, respectively. The new limit applies to mortgages acquired after 2017. The tax overhaul also capped write-offs for state and local taxes at $10,000 per return. Use the chart below from the National Association of REALTORS® to see the impact of the tax law on taxpayers in your state, or visit NAR’s resource page.

[divider style=”normal” top=”20″ bottom=”20″]

VERMONT

Of the approximately 178,000 owner-occupied houses in Vermont in 2016, 64% had a mortgage. 6.6% of the housing units with a mortgage had a value higher than $500,000 while 5.2% of the owners paid over $10,000 for real estate taxes. Vacation homes accounted for 17.4% of the housing units in Vermont.

Capital gains exemption

Under current tax framework, a typical owner, who has lived in his house for at least 2 years out of the last 5 years, will pay nothing in capital gain taxes if he sells his house. Under the proposed tax frameworks, owners need to live in their house for at least 5 out of the last 8 years in order to claim the exemption. Otherwise, they need to pay $945 in capital gain taxes.

In 2016, 10.5% of owners in Vermont have lived in their homes for 2-4 years. These owners will not be able anymore to take the exemption based on the proposed tax frameworks.

Impact on housing prices

If both mortgage interest and real estate taxes deductions will be eliminated, home prices expect to fall from 9% to 14%. A decline in value as projected could mean a loss in home value of $18,830 – $28,250 for the typical homeowner.

Sources: Internal Revenue Service 2015,

American Community Survey 2016,

National Association of Realtors® 2016, 2011;

All calculations are by the NAR® Research Group.